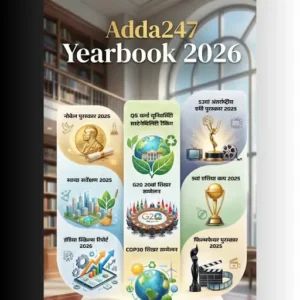

अगर आप सरकारी नौकरी की तैयारी कर रहे हैं, तो Hindi BankersAdda है आपका असली वन स्टॉप सोल्यूशन, जहाँ आपको मिलती है हर सरकारी नौकरी से जुड़ी लेटेस्ट खबरें, फिर चाहे बात हो Bank Jobs Update, SSC & Railway Jobs, Latest Govt Jobs और बिहार SSC, उत्तर प्रदेश पुलिस भर्ती, राजस्थान RPSC, मध्य प्रदेश व्यापमं, महाराष्ट्र MPSC, दिल्ली DSSSB, झारखंड JPSC राज्यों की सरकारी नौकरी की – यहाँ मिलेगा आपको सबसे तेज़, भरोसेमंद और विस्तृत अपडेट!

📢 अब नौकरी की तैयारी होगी आसान – सिर्फ hindi.bankersadda.com पर, हमारा उद्देश्य है कि हिंदी भाषी उम्मीदवारों को एक ही प्लेटफॉर्म पर पूरी जानकारी – जैसे आवेदन तिथि, पात्रता, सिलेबस, एडमिट कार्ड, रिजल्ट अपडेट और पिछले वर्षो के पेपर सहित प्रैक्टिस मटेरियल प्रदान करना है.

Latest Articles

- MP Police Constable Recruitment 2026: अप्रैल में मिलेंगे 7500 पुलिस आरक्षक, 6 महीने में पूरी होगी भर्ती प्रक्रियाFebruary 3, 2026मध्य प्रदेश में पुलिस भर्ती का इंतजार कर रहे लाखों युवाओं के लिए बड़ी और राहत भरी ...

- EMRS Result 2026 Out for Teaching & Non-Teaching Posts, डायरेक्ट लिंक से चेक करें EMRS रिजल्ट और कट-ऑफFebruary 3, 2026EMRS Result 2026 Out for Teaching & Non-Teaching: नेशनल एजुकेशन सोसाइटी फॉर ट्राइबल स्टूडेंट्स (NESTS) ने EMRS ...

- India-US Trade Deal Live Update: भारत-अमेरिका ट्रेड डील से शेयर बाजार में ऐतिहासिक उछाल, ट्रंप का बड़ा ऐलानFebruary 3, 2026भारत-अमेरिका ट्रेड डील से बदली बाजार की तस्वीर भारत और अमेरिका के बीच हुए ऐतिहासिक ट्रेड डील (India-US ...

- CG TET Question Paper 2026 PDF Download: यहां से डाउनलोड करें पेपर-1 और पेपर-2 प्रश्नपत्र PDFFebruary 3, 2026CG TET Question Paper 2026 को लेकर अभ्यर्थियों के लिए बड़ी अपडेट सामने आ गई है। छत्तीसगढ़ ...

- नाबार्ड डेवलपमेंट असिस्टेंट के 162 पदों पर आवेदन की अंतिम तिथि आज – जल्द करें अप्लाईFebruary 3, 2026नेशनल बैंक फॉर एग्रीकल्चर एंड रूरल डेवलपमेंट (NABARD) ने हाल ही में नाबार्ड डेवलपमेंट असिस्टेंट भर्ती 2026 नोटिफिकेशन ...

- RRB Section Controller City Intimation Slip 2026 हुई जारी, यहाँ से करें डाउनलोड और जानें किस सिटी मे होगी आपकी परीक्षाFebruary 3, 2026RRB Section Controller City Intimation Slip 2026 Out: रेलवे भर्ती बोर्ड (RRB) ने RRB Section Controller City ...

- MP Cooperative Bank Previous Year Paper: डाउनलोड करें एमपी कोऑपरेटिव बैंक पिछले वर्ष के क्वेशन पेपर PDFFebruary 3, 2026इस पोस्ट में MP Cooperative Bank Previous Year Question Paper PDF (Solved) उपलब्ध कराया गया है, जिससे ...